Future Proof Your Payments Infrastructure

As digital currencies and payments evolve to the next level, your payments infrastructure needs to keep pace

Adapt to Rapidly Emerging Currencies

As the world moves quickly towards new payment methods like A2A and Digital Wallets, the existing payments infrastructure and processes need a refresh to keep up with the rapid changes. With the move towards lower cost and more efficient domestic and cross-border payments, and the advent of digital currencies in various forms, the time is now to future-proof your payments infrastructure.

Why Omnumi for Payments Infrastructure Providers

Omnumi’s Platform is bridging the gap between today’s payments infrastructures and what the future of payments demands. By leveraging blockchain and DLT to modernize payments, the platform addresses current issues in fund storage and movement, while supporting the shift to digital currencies.

Turn complex processes into simplified payment flows, offering unparalleled efficiency, cost savings, and secure transactions, all while ensuring seamless integration with current and future payment technologies.

Leverage advanced technology that ensures transactions are not only faster but significantly more economical for both businesses and their consumers.

Support all forms of digital currency, from tokenized deposits to CBDCs and stablecoins, catering to the dynamic needs of the digital economy with enhanced compliance and security.

Empower businesses and consumers with smooth, widespread availability across various channels and devices, facilitating convenient and secure transactions anytime, anywhere.

Use Cases for Payments Infrastructure

Designed to support multiple entities, payment networks often incur extra costs and complexities due to disparate systems and participants, limiting access and harming user experience. Omnumi simplifies payment flows, reduces fund transfer costs, and enhances access for underserved populations domestically and globally.

Seamlessly send and receive money between individuals and experience the simplicity of instant transactions, ensuring reliability and peace of mind.

Streamline transactions for small businesses, enabling faster, secure, and hassle-free payment solutions.

Lower costs, improve customer experiences, and increase efficiencies with SVF and digital wallet-enabled cross-border remittances that benefit from centralized FX facilities.

Banks or NBFIs have the capability to address the larger population of foreign workers with better access to financial services and channels.

Special use Digital Wallets can be used to improve tourist and foreigner user experience and reduce the use of cash for many types of transactions by providing a digital payment experience similar to what is offered by the local RTP network.

Support for all types of disbursement use cases including social benefits, disaster relief, economic stimulus, and microfinance programs.

See the Platform in Action

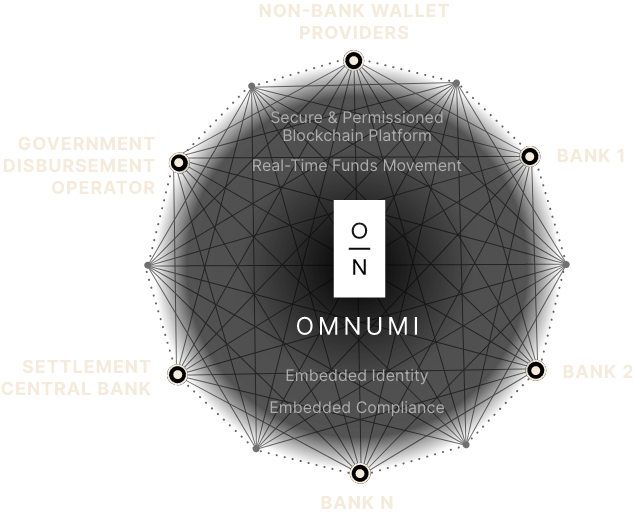

Multi-Bank Digital Currency Platform

The Omnumi Platform is a multi-tenant digital currency platform (DCP) that can support multiple banks with multiple account types on a single ledger:

- Retail consumers

- Small business merchants

- Large corporate clients

- Stored value cards

- Tourist digital wallets

The Settlement Bank is a tenant on the platform with each bank holding a wallet under the Central Bank for reserves and/or settlement purposes.

GDOs are tenants on the platform and can manage multiple disbursement programs such as Social Benefits, Economic Stimulus and Microfinance programs for eligible recipients and participants under their tenancy.

FinTech’s can be direct tenants on the platform and its customers are users/customers under their tenancy.

Bridging Existing & Emerging Financial Systems

Built around leading blockchain development standards, the Omnumi Platform makes it easy to accommodate new digital currencies with no need to recode, rebuild, or replace the platform.

Our PlatformBe at the Forefront

of the Digital

Currency Revolution

Contact us today to learn how your payments infrastructure can keep up as digital currencies and payments evolve.