Innovate in the Digital Era

Helping financial institutions build a digital payments platform that can compete with fintech and non-banks

Enabling You to Quickly Compete in Digital Currencies

Financial institutions need to modernize their complete payments infrastructure to be positioned for the digitalization of payments globally and the industry’s rapid move towards real-time payments networks, tokenization of bank deposits, and the emergence of CBDCs.

Why Omnumi for Financial Institutions

The Omnumi Platform streamlines the deployment of digital currency creation, movement, and storage service offerings, shortening time-to-market for banks looking to compete with new payments challengers and offer new innovative products and services to their clients.

Deliver rule-based composability through smart contracts that can automate various transactions and activities.

Augment legacy systems by enabling lower fees, real-time movement, and immutable traceability for all transactions.

Provide instant payment processing with counterparty transparency, reducing fraud and ensuring value is securely exchanged between financial institutions and their customers.

Take advantage of the inherent security of blockchain-powered transactions with embedded controls for fraud and regulatory compliance.

Use Cases for Financial Institutions

Omnumi’s Platform streamlines how financial institutions manage internal treasury operations and provide innovative new products and services to customers and business clients.

Remittances

Whether the requirement is to move funds across bank branches or across banks, cross-border payment can be simplified and made more efficient by utilizing an internal bank payment platform that is optimized to manage the payment flows.

Remittances

Tokenized bank deposits is becoming the most popular form of digital currency in the near future and supports multiple payment and customer acquisition use cases for all customer segments. Omnumi’s Platform was designed to support tokenized bank deposits from the start.

With Tokenized deposits, the power of programmable payments and money are enabled to support more innovative use cases and products that customers are looking for. From simple remittances to integrated financial supply chains, the use case possibilities are endless.

With an internal bank digital currency platform and payments ecosystem (OnUs/We Network Ecosystem), banks can build new products and services centered around their customers in and between all segments that promote better customer experiences and value.

For the more advanced clients that have regional or global treasury and payments requirements, an internal digital currency and payments platform can provide advanced services like intra-day liquidity visibility and centralized credit services across the bank’s network.

The Omnumi Platform, leveraged as an internal digital currency platform, provides support for next-generation treasury services, liquidity management, and credit decisioning services.

See the Platform in Action

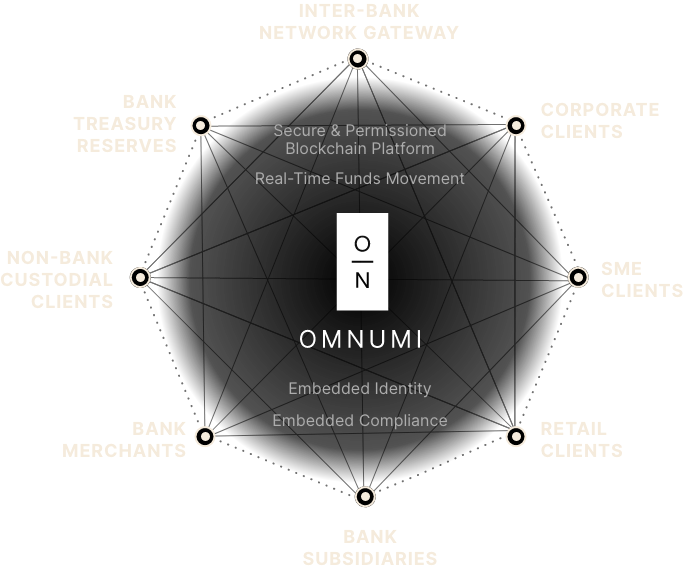

Intra-Bank Digital Currency Platform & Payments Ecosystem

Corporate clients can have their own tenancy on the network and use multi-wallet structures to mirror their own ERP or In-House Bank models for greater control of liquidity, disbursements and remittances.

Customer segmentations are supported for any segmentation or industry verticals.

Retail clients can be segmented by region or any grouping that is needed.

Bank charters, subsidiaries, and foreign branches can be set up as tenants on the network and shared ledger with their customers under their tenancy.

Merchants can be segmented separately and given wallets on the network to allow for real-time payment acceptance from bank customers (potentially a strong incentive for linking retail customers to merchant offers).

Non-bank account holders or bank customers can be given wallets, similar to stored value cards or e-wallets with limited capabilities to transact based on credentials and level of KYC. Powerful inclusion tool for bringing cash back into the banking system with greater digital adoption.

A bank can create wallets to hold tokens in reserve or tokens that are to be settled/redeemed (burned) for fiat currency that is held in reserve accounts. These can also be used for inter-bank atomic token swaps.

Inter-Bank Network Gateway provides each counterparty Bank on the IBN a wallet under a special tenancy for reserves and/or settlement purposes.

Bridging Existing & Emerging Financial Systems

Built around leading blockchain development standards, the Omnumi Platform makes it easy to accommodate new digital currencies with no need to recode, rebuild, or replace the platform.

Our PlatformBe at the Forefront

of the Digital

Currency Revolution

Contact us today to learn how you can transform your bank’s payment infrastructure with Omnumi’s secure and compliant digital payments platform.