Drive True Product Innovation

As regulatory frameworks become clearer globally, the tokenization of money is the next killer use case to drive innovation and growth in financial services

Theory Is Becoming Reality

For the past decade, fintechs have traditionally led the charge for product and service innovations in financial services. As the tokenization of real-world assets and now actual money moves from innovation to early adoption, the market is moving fast to find the next set of use cases and products.

Being left behind is not an option.

Why Omnumi for Fintechs

Fintechs need a platform and the right infrastructure to operationalize their next killer use case and product idea. Omnumi’s Digital Currency Platform, built on a universal ledger, can help accelerate time to market with next great product ideas or help make current products more efficient and accessible.

Simplify the process of transforming assets into digital tokens while ensuring compliance, security, and efficiency.

Provide robust support for multi-token types, enabling seamless management and transactions across various digital assets within a single platform.

Ensure seamless adherence to regulatory standards and enhanced security across all transactions.

Offer versatile solutions tailored to meet the unique needs of businesses and consumers alike.

Ensure reliability, compatibility, and scalability for integration into existing infrastructures and future-proof operations.

Use Cases for Fintechs

From enabling seamless cross-border remittances to facilitating programmable payments, Omnumi provides the essential infrastructure for fintechs to thrive in the ever-evolving digital economy.

By leveraging CBDCs for settling cross-border payments, businesses can avoid the delays and expenses typically incurred when processing transactions through correspondent banking networks.

Streamline the payment process while enhancing efficiency and reducing operational overhead, ultimately empowering organizations to conduct international transactions more seamlessly and cost-effectively.

Our Platform offers management of multiple currencies, allowing travelers to exchange, spend, and track funds while on the go. With real-time currency conversion and robust security features, Omnumi ensures a stress-free and convenient travel experience.

The Platform brings unparalleled flexibility and innovation to your financial transactions, enabling custom payment solutions that adapt to your unique business needs. Automate and streamline workflows, enhance security, and unlock new revenue opportunities with our cutting-edge technology, all while delivering a seamless user experience.

Leverage the reliability of regulated digital assets with a secure, compliant, and stable environment for transactions. Benefit from the efficiency and transparency of blockchain technology, while adhering to regulatory standards, ensuring your transactions are both compliant and secure.

Harness the power of blockchain for tokenizing assets, opening up a world of possibilities for secure, transparent, and efficient transactions. Whether you’re looking to streamline payments, access new investment opportunities, or enhance liquidity, Omnumi provides the tools and infrastructure necessary to navigate the digital economy.

See the Platform in Action

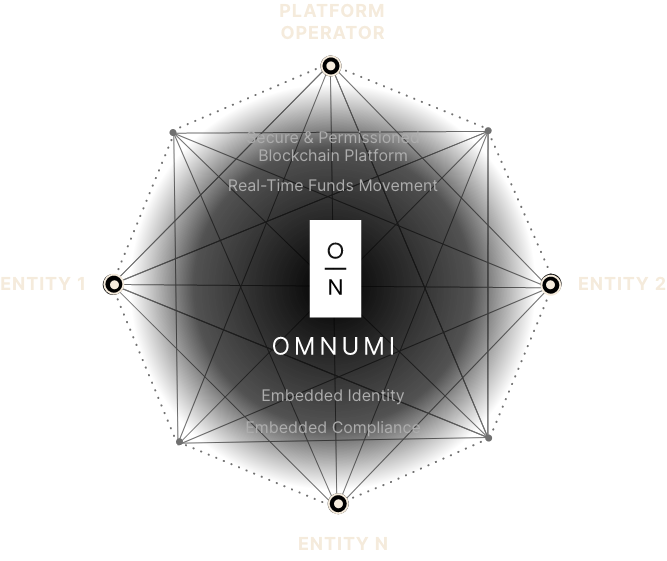

Multi-Entity Digital Currency Platform

Entity N is any tenant on the platform and its customers are users/customers under their tenancy.

The Platform Operator has a tenancy on the platform where it manages reserve and settlement wallets for all Digital Assets and each Entity may have a user wallet in this tenant for reserves and/or settlement purposes.

Bridging Existing & Emerging Financial Systems

Built around leading blockchain development standards, the Omnumi Platform makes it easy to accommodate new digital currencies with no need to recode, rebuild, or replace the platform.

Our PlatformBe at the Forefront

of the Digital

Currency Revolution

Contact us today to learn how you can digitize your financial services with Omnumi.