Achieve Your Digital Economy Policy Objectives

Digital currency is foundational for successful policy related to the future digital economy and the move to a more cashless and inclusive society

Central Bank Digital Currency Is R.E.A.L.

Nearly 93%of central banks are engaged in some form of CBDC work; either in Research, Experimentation, Analysis, or Launch phases (R.E.A.L). Sixty-four countries are in an advanced phase of exploration while 11 have already adopted a CBDC, leaving just over 40% in early phases of development. Central Banks need to find the right platform to support and manage their Digital Currency Policy objectives.

Why Omnumi for Central Banks

The Omnumi Platform is designed to support all forms of digital currencies, including regulated stablecoins, tokenized deposits, and CBDC in the future. All at the same time and on the same platform.

Support all forms of digital currency and offer a versatile and future-proof solution that caters to the dynamic needs of the digital economy with enhanced compliance and security.

Provide comprehensive support and adaptable models to help integrate and navigate the complexities of digital currency ecosystems, ensuring efficiency, security, and financial inclusion.

Enable efficient oversight, regulatory compliance, and seamless administration to optimize operations and mitigate risks with centralized management tools.

Support the tokenization of assets and liabilities to address multiple use cases for digital currencies, not just digital assets with the Omnumi platform. This is fundamental to creating benefits that will help drive adoption.

Use Cases for Central Banks

Many Central Banks must manage economic policy that also drives inclusion and supports the digitalization of the economy. This requires a balance of objectives that sometimes create friction and impact adoption of the intended benefit. With clear use cases for a digital currency that can help improve adoption and a platform that can manage it, Central Banks better achieve their policy objectives.

Support for all types of disbursement use cases including social benefits, disaster relief, economic stimulus, and microfinance programs.

- Create pathways to financial inclusion and a cashless society

- Reduce disbursement costs to businesses and governments

- Reduce fraud and corruption

- Increase convenience for recipients

CBDCs empower central banks to actively engage in the rapidly digitizing economy.

Leverage the adaptable platform to pioneer innovative financial services and lead the evolution of digital currencies while shaping the future of finance.

Extended use for underbanked/unbanked populations to support equality and inclusion and cashless society goals without overloading existing banking systems.

Identity and compliance controls can be programmed into the use of funds based on credentials.

By leveraging CBDCs for settling cross-border payments, businesses can avoid the delays and expenses typically incurred when processing transactions through correspondent banking networks.

Streamline the payment process while enhancing efficiency and reducing operational overhead, ultimately empowering organizations to conduct international transactions more seamlessly and cost-effectively.

See the Platform in Action

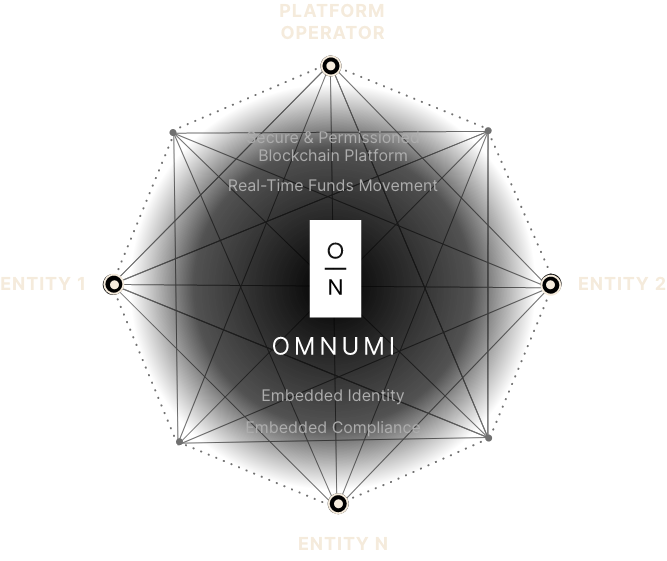

Multi-Entity Digital Currency Platform

Entity 1-N is any tenant on the platform and its customers are users/customers under their tenancy.

The platform operator has a tenancy on the platform where it manages reserve and settlement wallets for all digital assets and each entity may have a user wallet in this tenant for reserves and/or settlement purposes.

Bridging Existing & Emerging Financial Systems

Built around leading blockchain development standards, the Omnumi Platform makes it easy to accommodate new digital currencies with no need to recode, rebuild, or replace the platform.

Our PlatformBe at the Forefront

of the Digital

Currency Revolution

Contact us today to learn how you can unleash the power of digital currency.